How to Avoid Mistakes While Filing ITR in 2025

Summary

Avoiding mistakes while filing ITR in 2025 is all about awareness, preparation, and using the right tools. With increasing digital integration, taxpayers are under greater scrutiny—but also have better resources to stay compliant. Start early, double-check your information, and file the best ITR filing services with confidence. Quicker returns and peace of mind are ensured by a transparent, error-free ITR.

Filing your Income Tax Return (ITR) accurately is more critical than ever in 2025. With increasing automation, AI-based scrutiny, and updated compliance measures, even small errors can lead to delays, income tax notice, or penalties. Despite government efforts to simplify filing through pre-filled data and digital integration, many taxpayers still make avoidable mistakes. In this article, we’ll walk you through the most common ITR filing errors and how to avoid them, along with the latest updates and expert-approved tips on how to file ITR online error-free. Its important to check itr form revision correction after sumitting e filing of income tax.

Why Mistakes in Filing ITR Happen in 2025

While filing has become more tech-friendly, mistakes continue because of:

-

Over-reliance on pre-filled data without cross-verification

-

Lack of awareness about updated ITR forms

-

Confusion between AIS, TIS, and Form 26AS

-

Claiming wrong deductions or missing key disclosures

-

Filing without checking data properly to fulfill deadlines

|

Mistake

|

Impact

|

How to Avoid

|

|

Using wrong ITR form

|

Rejection of return or notice from IT department

|

Check applicable form based on income source before filing

|

|

Not reporting all income (e.g., interest, freelancing)

|

Underreporting leads to penalties or scrutiny

|

Include salary, savings account interest, capital gains, etc.

|

|

Mismatch in Form 16 & 26AS

|

Return may not be processed or refund delayed

|

Cross-check Form 26AS with Form 16/TDS details

|

|

Missing deductions (like 80C, 80D)

|

Higher tax liability

|

Keep records and claim all eligible deductions

|

|

Incorrect bank account or IFSC code

|

Refund fails or gets delayed

|

Double-check bank details before submission

|

|

Filing with incorrect PAN or Aadhaar

|

Return may be invalid

|

Verify PAN and Aadhaar before uploading return

|

|

Not verifying ITR after submission

|

Return is considered incomplete

|

E-verify using Aadhaar OTP, Net Banking

|

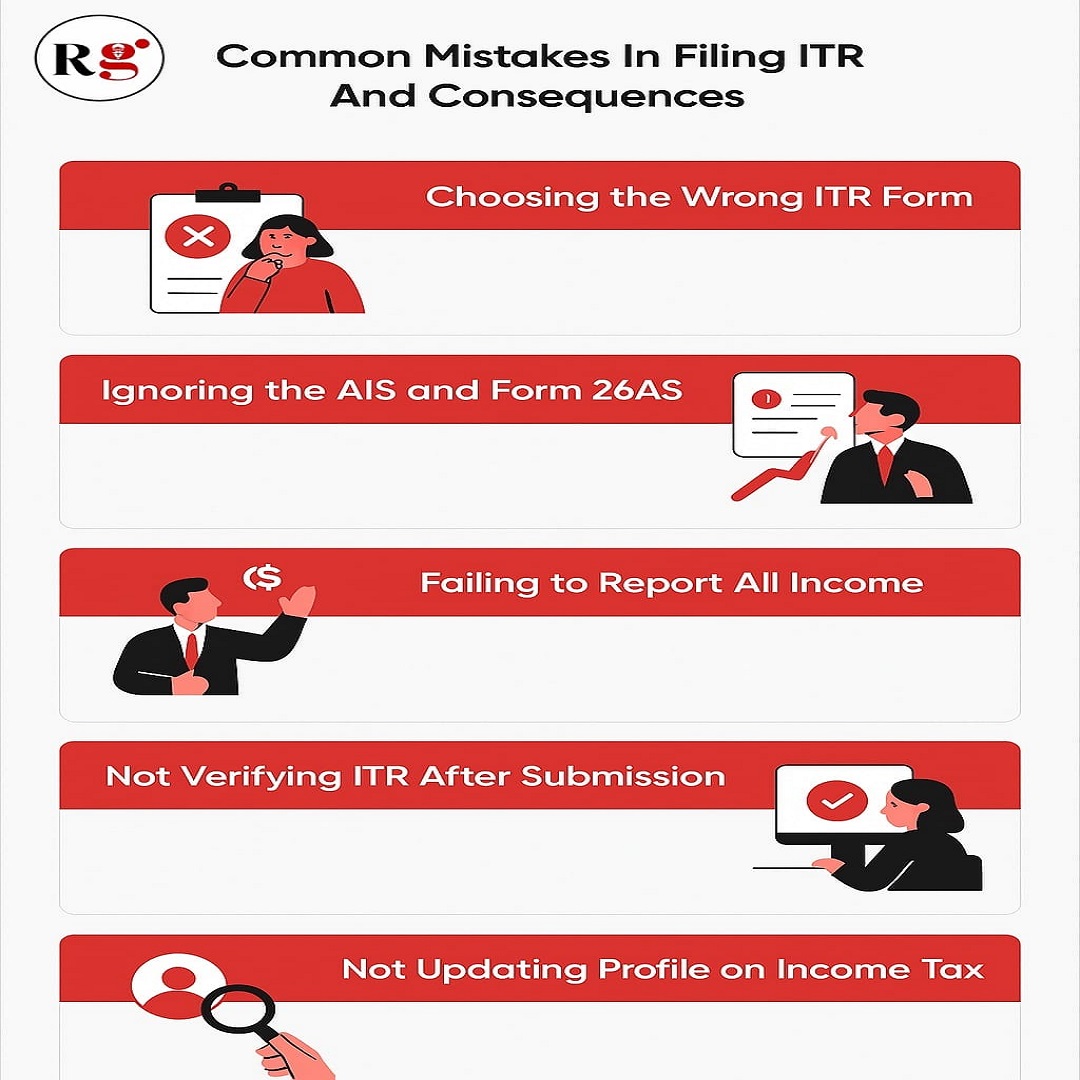

Top 10 Mistakes You Must Avoid While Filing ITR

1. Choosing the Wrong ITR Form

If you are not choosing the ITR form, your return may be considered invalid. For example, salaried individuals with capital gains or foreign assets must use ITR-2 or ITR-3, not ITR-1.

2. Ignoring the AIS and Form 26AS

The Annual Information Statement, or AIS, contains all revenue information, including dividends, interest, overseas remittances, and more. Mismatches between your ITR and AIS/Form 26AS may trigger scrutiny or notices.

3. Failing to Report All Income

Freelancing, crypto, rental income, or even high-value transactions are often skipped unintentionally. In 2025, the IT Department has increased its data-sharing with other platforms to detect unreported income.

4. Entering Incorrect Bank Details

If IFSC codes or account numbers are wrong then refund must be delayed. Always validate bank accounts before filing income tax return.

5. Not Verifying ITR After Submission

Filing your return is not enough; it must be e-verified within 30 days (via net banking, Aadhaar OTP, etc.) or it will be deemed not filed.

6. Claiming Ineligible Deductions

Claiming HRA without rent receipts or medical deductions without valid bills can result in rejection or fines.

7. Filing After the Due Date

Filing post-deadline leads to late fees (under Section 234F), and you lose the chance to revise or carry forward losses.

8. Failing to Disclose Foreign Assets or Crypto

In 2025, failing to disclose crypto or foreign assets can invite heavy penalties and even prosecution under Black Money Act.

9. Not Updating Profile on Income Tax Portal

The profile section is now critical for better matching pre-filled data. Not updating your profession, address, or bank info can cause processing delays.

10. Overlooking Tax Credits & TDS Mismatch

Missing tax credits like TDS on interest income can lead to under-reporting. Always reconcile with Form 26AS & AIS before finalizing.

What the 2025 ITR Filing Rules Will Include

-

Before submitting, AIS and TIS must now be reviewed.

-

Income Tax App 2.0 allows e-verification, refund tracking & live chat help.

-

AI-based risk profiling flags inconsistent entries instantly.

-

Pre-filled data from mutual funds, banks, EPFO, brokers, and credit cards now integrated automatically.

-

Enhanced compliance alerts for high-value deposits, credit card spends, and foreign remittances.

Expert Tips to Avoid Errors

-

✅Before beginning, reconcile Form 16, AIS, and 26AS.

-

✅ Start early to avoid deadline pressure

-

✅ Use CA support if you have business income, capital gains, or foreign assets

-

✅ Don't skip e-verification

-

✅ Double-check deductions and exemptions with valid proofs

-

✅ Cross-verify PAN-Aadhaar link status and bank validation before refund

FAQs

Q1. Will I be able to submit my own ITR in 2025 without a CA?

Yes, if you have simple income sources. Use AI tools or ClearTax for assistance. Complex cases should consult professionals.

Q2. What happens if I don’t verify my ITR?

We will consider your return to have been not filed. After filing, you will have thirty days to confirm it.

Q3. Is AIS mandatory to review?

Yes, it’s strongly recommended. Tax notices and mismatches could result from ignoring AIS.

Q4. Can I revise ITR if I made a mistake?

Yes, you can revise your ITR filing services before the assessment deadline, typically Dec 31st of the same assessment year.