ITR Filing Deadline for FY 2024-25: Why You Should File on Time

Filing your Income Tax Return (ITR) might feel like a routine task, but doing it on time can save you from a lot of future trouble. Whether you’re a salaried employee, a freelancer, or a business owner, the income tax return filing deadline is the same—and missing it comes with real consequences.

Let’s break down the current deadline for filing taxes in 2025, the benefits of filing ITR timely, and what happens if you delay it.

What Is the ITR Filing Deadline for FY 2024‑25?

The original deadline to file ITR for Financial Year 2024‑25 (Assessment Year 2025‑26) was July 31, 2025. However, the CBDT officially income tax return extended this deadline to September 15, 2025 for individuals, HUFs, and non-audit taxpayers due to revised ITR forms and system readiness needs. Now according to new guidlines itr filing last day is 15 September 2025

Deadlines by Taxpayer Category:

-

Non‑audit cases (individuals, salaried, freelancers): September 15, 2025

-

Audit‑required businesses: October 31, 2025

-

International transactions (transfer pricing): November 30, 2025

-

Belated/revised ITRs: December 31, 2025

-

Revised returns (per the new regulations) must be submitted by March 31, 2030 (within 48 months).

✅ Benefits of Filing Income Tax Return on Time

1. Avoid Late Fees and Penalties

Timely ITR filing in India means zero late fee under Section 234F. Consequences for filing after the final day might reach ₹5,000.

2. Faster Refunds

If you're eligible for a refund (TDS refund, excess tax paid, etc.), filing early ensures quick processing and faster credit to your account.

3. Proof of Income

ITR acts as an official income proof for loan approvals, visa applications, and more.

4. Carry Forward of Losses

If you have business or capital losses, you can only carry them forward to the next year if you file your ITR before the due date.

5. Avoid Interest on Tax Due

Late filers may have to pay interest under Sections 234A, 234B, and 234C for unpaid or underpaid taxes.

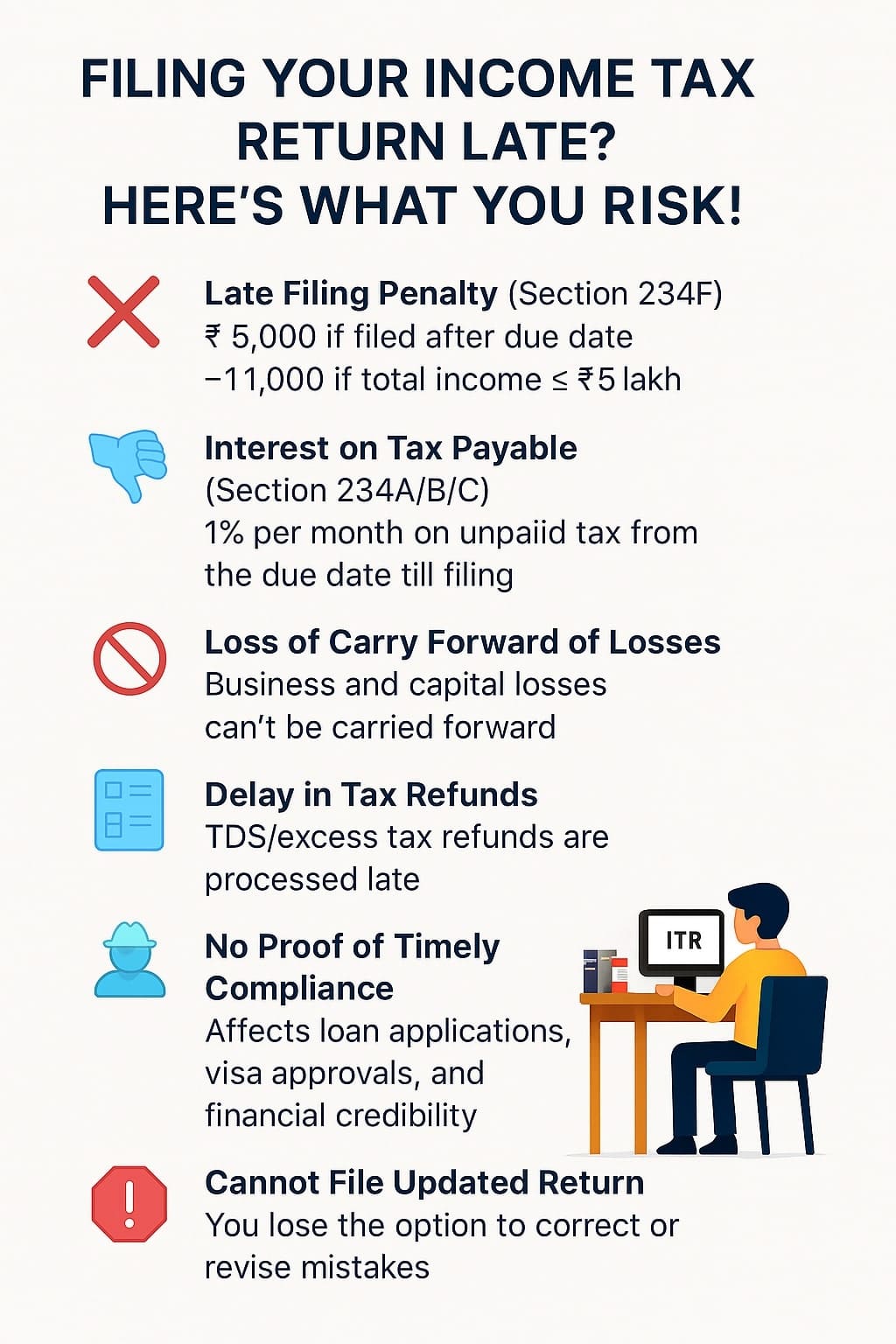

⚠️ Consequences of Delayed ITR Filing

Missing the ITR dead line doesn’t just cause financial penalties—it can affect your compliance record. Here’s what happens:

❌ 1. Late Filing Penalty (Section 234F)

-

File after July 31 but before Dec 31: ₹5,000 penalty

-

When the revenue is not more than ₹5 lakh, the highest penalty amount will be ₹1,000.

❌ 2. Interest on Tax Payable

You’ll be charged 1% interest per month (or part of the month) on unpaid tax from the due date till the actual filing date.

❌ 3. No Carry Forward of Losses

You cannot carry forward losses under "Capital Gains" or "Business Income" if you will not follow the income tax return last date.

❌ 4. TDS Refund Delay

If excess TDS is deducted, your refund will be delayed if you file late.

❌ 5. Risk of Income Tax Notice

Delays or non-filing increase the chances of scrutiny and receiving a tax notice from the Income Tax Department.

FAQs:

Q1: What happens if I miss the ITR filing deadline for FY 2024–25?

If you miss the deadline (now extended to September 15, 2025), you may face a penalty up to ₹5,000, interest on tax payable, and may lose the ability to carry forward certain losses.

🔸 Q2: How much penalty will I have to pay for filing ITR late?

-

₹5,000 if filed after the due date

-

₹1,000 if your total income is below ₹5 lakh (under Section 234F)

🔸 Q3: Can I still claim my tax refund if I file ITR late?

Yes, you can still claim a refund, but it might get delayed and may undergo additional checks or scrutiny.

🔸 Q4: Will I be able to carry forward business or capital losses if I file late?

No, delayed filing disqualifies you from carrying forward losses, which could lead to higher tax liabilities in future years.

🔸 Q5: Does late filing increase the chance of receiving a notice?

Yes, the Income Tax Department may treat consistent late filing as non-compliance, increasing the risk of scrutiny or tax notices.

🔸 Q6: Can I revise or update my ITR if I file it late?

No, if you miss the deadline, you cannot revise the return later. You also lose eligibility for filing an Updated Return under Section 139(8A).

🔸 Q7: Is there any interest charged if I delay filing and have unpaid taxes?

Yes, you’ll be charged 1% interest per month (or part month) under Sections 234A/B/C for unpaid or delayed tax payments.